Microsoft Dynamics 365 Finance: Asset Leasing Part 2

The implementation of the accounting standards FASB ASC 842 and IFRS 16 created the need for additional functionality within ERP systems. To address this, Microsoft has developed a new module in Dynamics 365 Finance dedicated to the management of asset leasing. In part two Luis Cruz takes a further look at the asset leasing tool and provide details on some of the additional functionalities.

With the implementation of the accounting standards FASB ASC 842 and IFRS 16 created the need for additional functionality in ERP systems. To address this Microsoft has developed a new module in Microsoft Dynamics 365 Finance dedicated to the management of the leased asset. In part two I will take a further look at the asset leasing tool and provide details on some of the additional functionalities.

4. Asset Leasing – Multiple scenarios

4.1 Lease Contract Adjustments

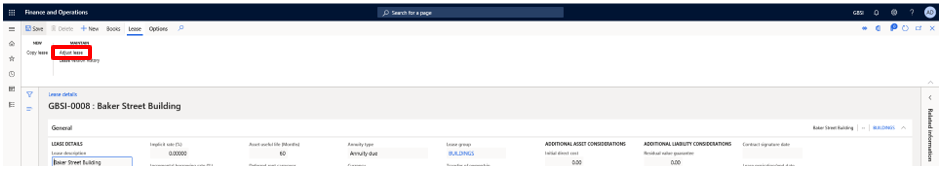

Dynamics 365 Finance allows adjustments and changes on the lease contract. On the lease master record, there is the option Adjust lease.

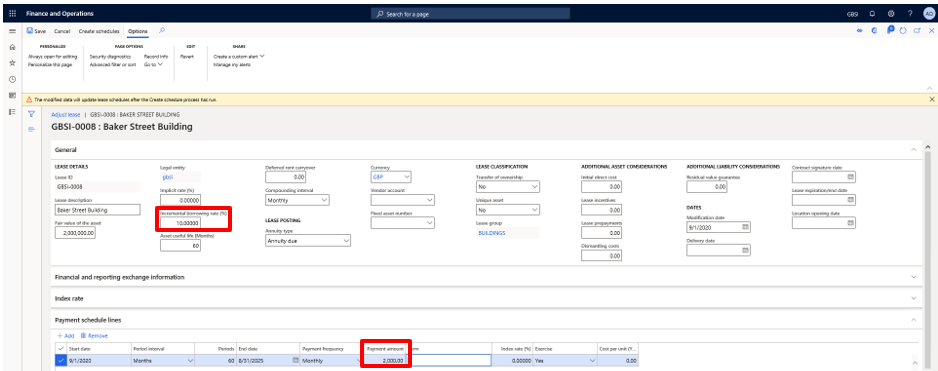

- This feature will open the lease contract to changes (the fields become editable), for example, to change the payment schedule or the borrowing rate (that we have done for this scenario), but all the others are open for changes as well.

- From this point, it is required to Create schedules once again in order to adjust the values of the previously created schedules for the original contract. When Create schedules action is done it will adjust all the schedules of the lease books. Then, the payment schedule must be confirmed and a lease adjustment journal needs to be created and posted.

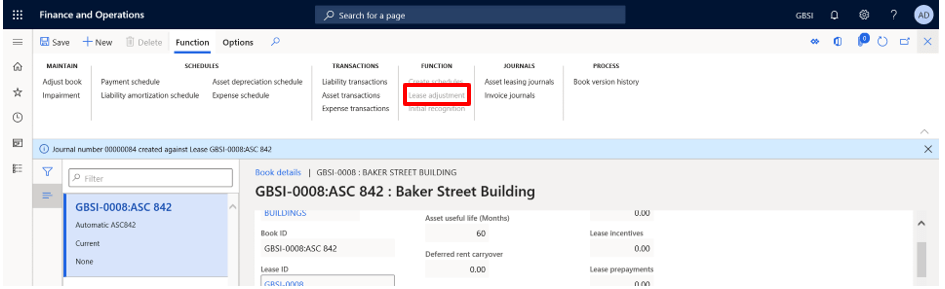

- The lease adjustment function is found in Books under Function.

Then, on the Asset leasing journals, it can be posted. This will adjust the balances of both Right of use asset value and the Lease liability.

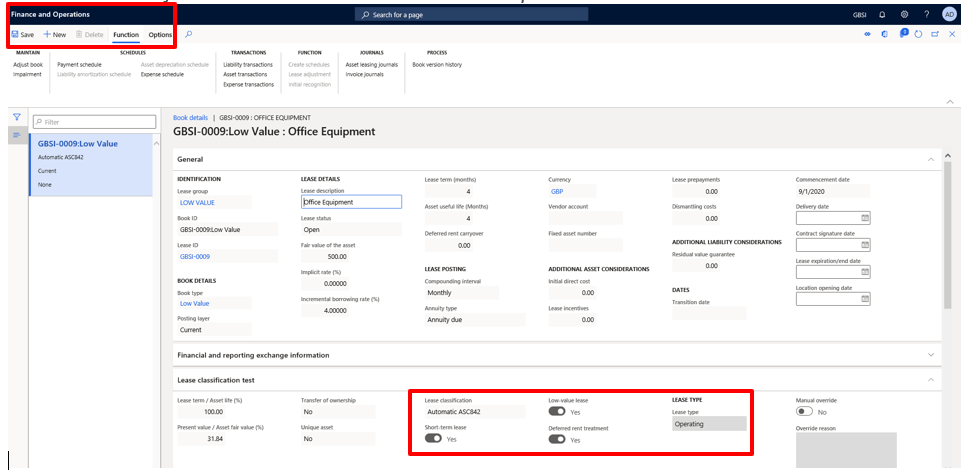

4.2 Low value and Short-term lease

As it was demonstrated before, on the lease books there are criteria that companies can define in order for the system to classify a lease as low value or short-term lease. When a user enters a lease that satisfies this criteria, the system classifies the lease that way.

When a lease contract is defined as a low-value lease or short-term lease, the initial recognition journal is neither required nor enabled, the system only allows the treatment of payments through a Payment schedule. There is no liability amortization schedule neither asset depreciation schedule.

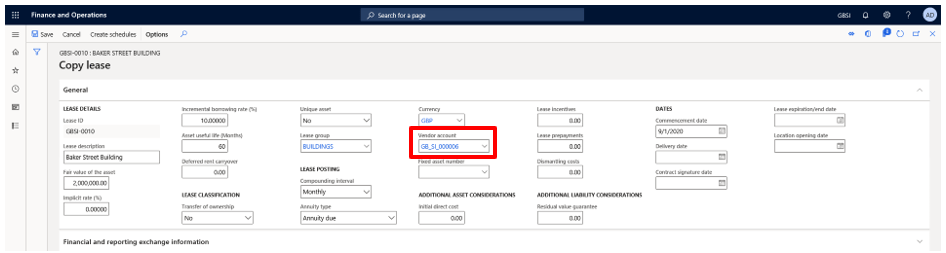

4.3 Lease contract linked to a vendor

Another great functionality provided by the application is the ability to link a vendor to the lease contract. This automates the process for when payment is created, the liability is automatically posted to the provider of the lease.

- Step 1 – Enable Pay to vendor parameter on the Lease Books: By enabling this parameter, the system will post the payments on the Accounts payable sub-ledger.

- Step 2 – Select the vendor on the Lease master record: As always for any finance or operational the basic steps are required: create schedules, confirm payment schedules and post the Initial recognition journal.

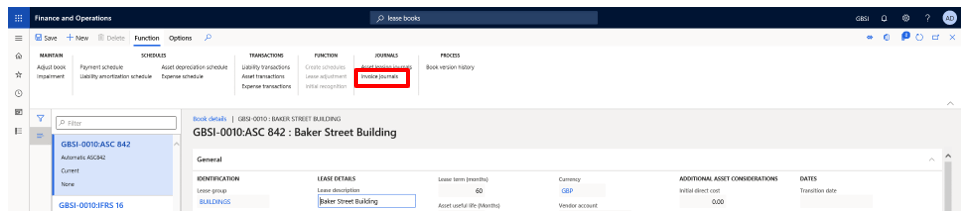

- Step 3 – Create and post the invoice journal: When we create the lease payment journal through the Lease payment schedule instead of reviewing and posting the journal from the Asset Leasing Journals, we must go through the Invoice journals form (available in the lease book).

- From the screen below it is possible to review and post the journal. The offset account is the vendor account linked to this lease. This is a good feature to make the lease postings more efficient and create a balance on the vendor directly.

4.4 Link Lease contract to a Fixed Asset

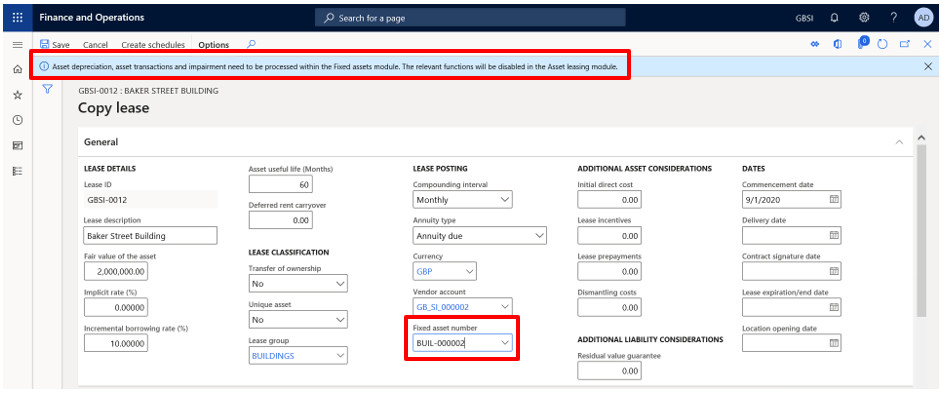

The Asset Leasing functionality also includes the option to be integrated with the Fixed Assets module. If we create a Fixed Asset related to the leasing, we can link that Fixed Asset record to the lease record.

This functionality will break-down the process and the asset side of the lease will be processed on the Fixed Asset module (namely the depreciation), while the liability side will continue to be processed on the Asset Leasing module.

- Step 1 – Create the Fixed asset record on the Fixed Asset module: At this point on the Fixed asset module, nothing else is required to be done.

- Step 2 – Create the lease record and select the Fixed Asset created for this purpose

- As soon as a Fixed Asset number is selected to be linked to the lease, the system displays the following message: “Asset depreciation, asset transactions and impairment need to be processed within the Fixed assets module. The relevant functions will be disabled in the Asset leasing module.”

- Therefore, clearly that only the liability side and the payments will be treated on the Asset Leasing module, while the asset related transactions will be processed in Fixed Assets module.

- This provides an additional option to the companies to decide how they want to deal with the leases.

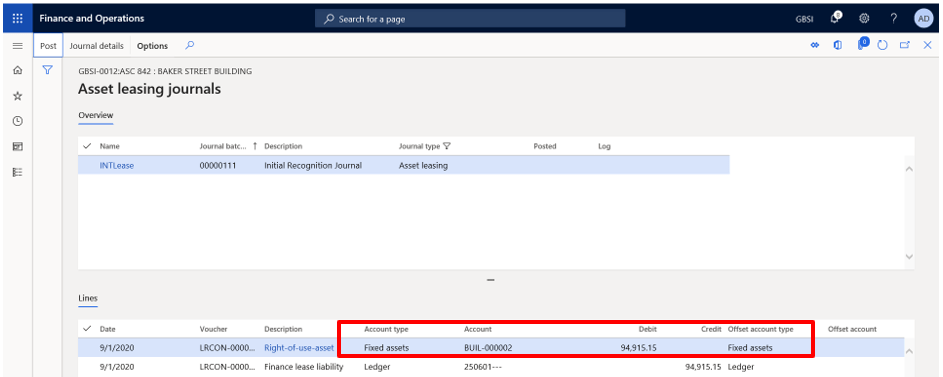

- Step 3 – Post initial recognition journal

- The initial process is similar to the original scenario. The schedules must be created and the Payment schedule must be confirmed and posted to create the Right of Use Asset balance on the asset side.

- However, this time, on the initial recognition journal the balance is posted directly into the Fixed Assets sub-ledger (whilst if the lease was not linked to a Fixed Asset it would be posted against the ledger account defined on the Accounts setup of Asset leasing module parameters).

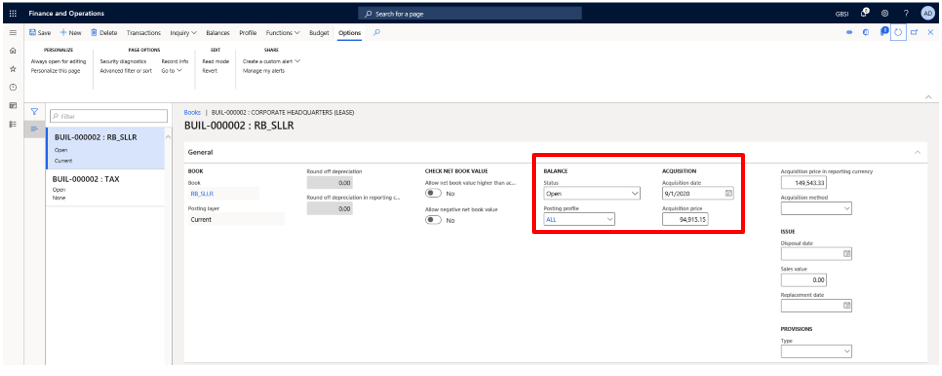

- When the initial recognition journal is posted the Fixed Asset status changes from Not yet acquired to Open. The same happens to the lease. The Acquisition price is the same as the sum of Present value of all lease contractual payments, and the acquisition date matches the commencement date of the lease.

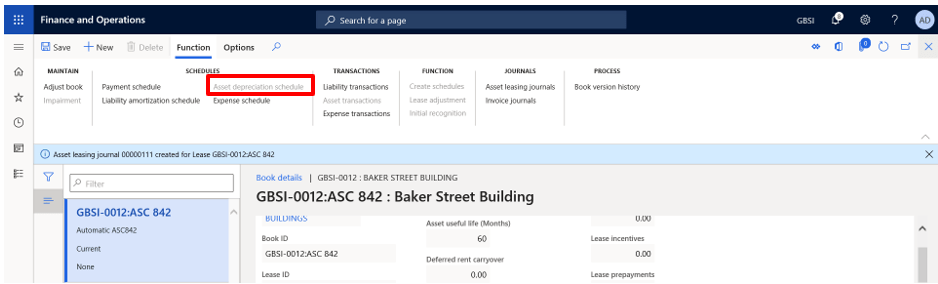

- As expected, on the lease books the Asset depreciation schedule is disabled.

5 Asset Leasing – Additional Functionalities

5.1 Available Batch Jobs

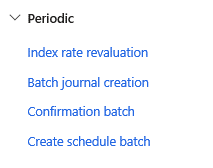

The Asset leasing module also offers a wide variety of batches that will allow companies to be more efficient in some tasks under Asset Leasing > Periodic section.

5.1.1 Create Schedule batch

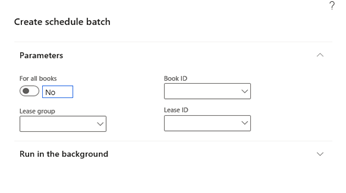

The Create schedule batch makes it possible to create schedules for several lease records that are created and allows users to filter based on several criteria.

5.1.2 Confirmation batch

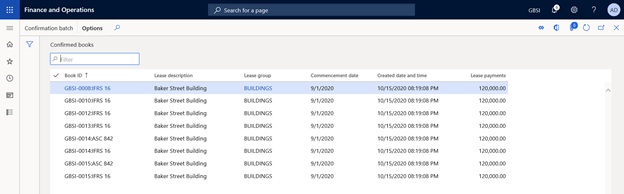

The confirmation batch will allow users to automatically confirm schedules of leases that are created and with the schedules already created.

- After running it, all confirmed schedules and respective books are displayed on the table.

5.1.3 Batch Journal Creations

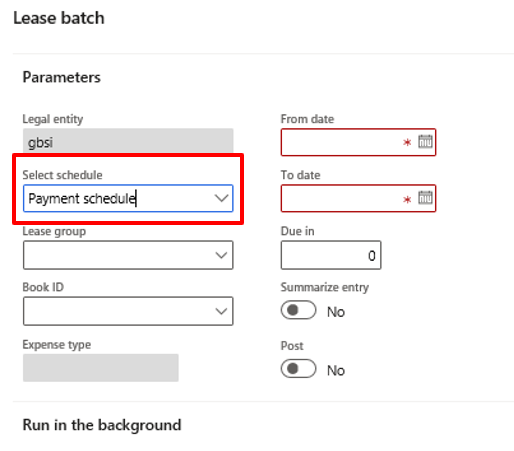

This batch can really improve the efficiency of the way companies treat leases. It can be found on Asset Leasing > Periodic Tasks > Batch Journal creation.

- The user defines the period and the system will generate all the transactions scheduled for the selected schedule, such as payment schedule or asset depreciation schedule.

- The functionality also allows the journals to post automatically.

- This is a game-changer because all the tedious manual work can be done in a few clicks.

- As it happens for any batch job, it can be set on a recurrence to run.

These batches described above makes some of the processes and transactions to be done much more quickly, particularly, when a company has to process a large volume of leased asset transactions.

5.2 Reports

The new asset leasing module within Microsoft Dynamics 365 Finance offers inquires and reports that allow companies to find, track and review all the transactions related to their lease contracts.

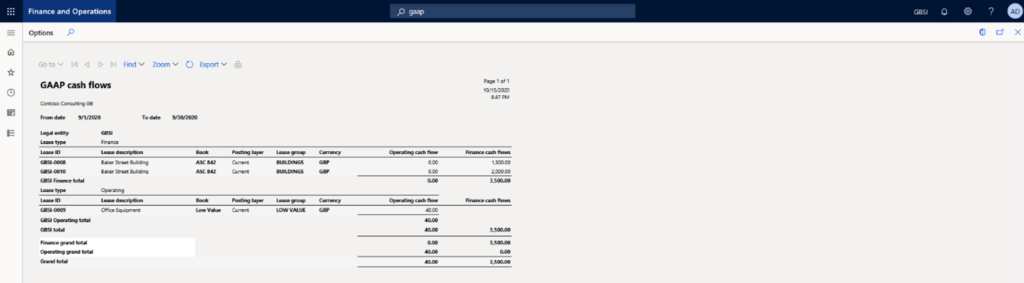

In addition, there are two disclosure reports that can be useful for companies following the US GAAP accounting framework.

There is the CAAP – cash flows which comply to the US GAAP disclosure requirement specified in 842-20-50-4(g)(1).

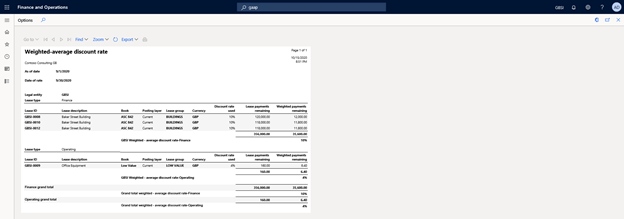

The Weighted-average discount rate report also complies with the US GAAP disclosure requirement specified in ASC 842-20-50-4(g)(4) for a weighted-average discount rate.

5.3 Lease Import Framework

It is important to highlight that Microsoft has developed an import framework to be used in this module that will allow companies to import lease contracts using data entities. This is a major feature since it can save a lot of time of users entering manually the lease contracts information in the system.